Overview

Since the end of World War II, the U.S. dollar has reigned supreme as the world’s reserve currency, facilitating international trade and acting as a safe haven for global financial transactions. However, the landscape is shifting, and various factors are challenging the dollar’s dominance. Currently, we see several threats faced by the U.S. dollar as a reserve currency that could potentially lead to its replacement with other currencies as follows:

Geopolitical Shifts and De-Dollarization Efforts:

International tensions and the desire to reduce dependence on the U.S. have sparked de-dollarization efforts among countries and international entities. As nations seek to protect themselves from the effect of currency and trade sanctions, they are actively exploring alternatives to the dollar.

Rise of Regional Trading Agreements and Digital Currencies:

As the European Union’s currency, the euro has emerged as a strong contender for reserve currency status within its regional sphere of influence. With a robust economy and growing prominence, the euro has the potential to challenge the dollar’s dominance. The advent of digital currencies, including central bank digital currencies (CBDCs), could also disrupt traditional trade and financial settlement systems.

Special Trade Zones and Diversification:

Emerging economies such as China, India, and Brazil are gaining economic strength and influence. These nations actively seek to diversify their reserve holdings away from the dollar to reduce exchange rate volatility and exposure to a single currency. Increased trade between countries in a region using their own currencies and regional currency swap agreements are examples of diversification efforts that could undermine the dollar’s reserve status.

Volatility and Loss of Confidence:

The U.S. dollar’s status as a safe haven currency has been bolstered by its perceived stability. However, the 2008 global financial crisis and the growing debt to GDP (now at 123%), have raised doubts about the dollar’s long-term stability. If confidence declines in the dollar, investors and central banks may seek alternative currencies leading to a shift away from the dollar as a reserve currency.

While the U.S. dollar has long held the world’s reserve currency position, it is not immune to challenges. Replacing the dollar with another currency as the global reserve currency would require significant conditions to be met. But, if we are not diligent about the many benefits the U.S. dollar enjoys, it can be frittered away. History offers detailed lessons on those who do not protect their currencies. The French franc and the British pound sterling experienced significant costs and loss of influence when their respective currencies were abandoned as reserve currencies.

The topics addressed in this interview are:

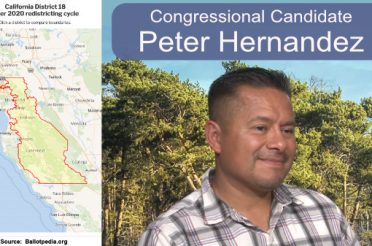

- 00:00 Intro to Riski Kumar

- 01:31 Results from the 2022 election

- 03:21 The risk of de-dollarization

- 05:18 AI and the Effect on Jobs

- 06:05 The U.S. Dollar and economic challenges

- 08:41 The Gerontocracy in DC

- 10:02 The misuse of power

- 11:46 The rise in crime, Prop 47

- 16:06 Challenging the Incumbent in Politics

- 18:08 Utility bills based on income, AB205

- 20:46 Changes in California’s population

- 21:04 Addressing CPUC regulators in utility billing procedures

- 21:57 Money in Politics

- 23:29 Contact information

Contacts

Rishi Kumar : info@rishi4congress.com

Jim Connor : jconnor@gamechangers.tv

Website Link - : www.RishiKumar.com

Leave a Reply

You must be logged in to post a comment.