Overview

Part 1: Companies are bought, not sold

Our story starts out in an unusual way. Ken Burke, the Founder, and CEO of a growing e-commerce company believes he is doing everything right. Suddenly, he is informed of a board decision to replace him with an experienced manager who will grow the company to the next level.

The new CEO fails to deliver the promised results and, in fact, takes the company into a downward spiral.

The company was adrift, seemingly headed for insolvency and failure, when the board asked Ken if he would return as the CEO role and stabilize operations. Shortly afterward, Ken engaged Mark Addison of Xrocket.io to help rebuild the company’s valuation and prepare the company to be sold.

This podcast addresses the following topics:

- The emotions experienced by the Founder and CEO when he was replaced.

- Watching the new CEO underperform and decimate the value of the company.

- The founder’s decision to return to the CEO role

- Rebuilding operations – the five key initiatives

- Developing a strategy to raise the company’s valuation

- Strategies and methods to create thought leadership

Join us for Part 1 of this two-part series on Companies are Bought, Not Sold.

Transcript

Transcript: Companies are Bought

Jim

Every startup company will eventually address their end game known as their exit. The most common goal is to be acquired by a larger company. There are a number of strategies a startup can deploy to maximize their contact with potential acquirers. But it’s difficult as corporate buyers acquire companies that fit specific private objectives and strategies of which you, the startup, have no detailed knowledge.

Our story starts out in an unusual way. The founder and CEO of a growing e-commerce company believes he is doing everything right, aggressively growling the business, keeping his eyes open for a potential acquisition. Suddenly, in a board meeting, he is informed that the board is going to bring in an experienced hand to take over the CEO role and take the company to the next level.

Ken Quote: After my third round of investment and we had Sequoia Capital the best you know in the best of Silicon Valley come in as our lead investor in the first round and we rode through two additional rounds with them we had one bad quarter and I remember sitting in that boardroom and they’re like You know what. We want somebody that’s seen the movie before. So if anybody ever tells you you know we’re going to bring somebody in that’s seen the movie. I don’t know that I would believe it because who they brought in hadn’t seen the movie it was a corporate executive. I was told we were going to get the best of the best and I’m like OK. They said hey you haven’t done their national yet you haven’t built channels yet but you’ve built a really nice company right.

Mark Quote: As an adviser to companies. We’ve seen the movie a bunch of times and typically there are multiple stages and you get a founding CEO who’s usually very engineering-driven and close to the product and then at some point the voices suggest maybe a second growth CEO and they scale the company and then the third stage. Oftentimes it’s sort of like an exit CEO who has a network to find out the probable buyers. And that happens actually more often than you would think.

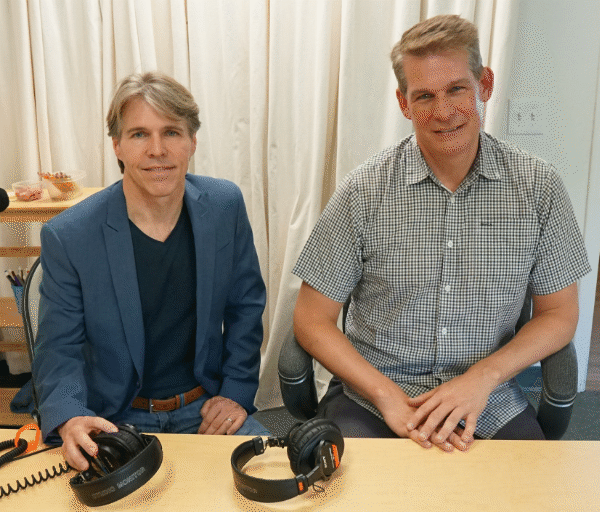

We had an opportunity for a candid conversation with Ken Burke, Founder and former CEO of Market Live, high growth e-commerce company, and Mark Addison, CEO of X-Rocket. XROCKET helps companies implement a valuation strategy and get acquired at optimal prices. In this particular case, Mark was a critical contributor to rebuilding the reputation and the valuation turn-around at MarketLive.

Let’s join the conversation with Ken and Mark starting with the issue of Ken being removed as the CEO of the company.

Jim: Ken, I want to start with you because we’re going to talk about the fact that companies are bought and sold and every entrepreneurial world thinks that they can get ready and sell their company. But the fact is most of the time it doesn’t work that way that you have to get your company ready and you had a very unique experience not unknown but your experience was you built the company up the company reached a state where the investors and the boards it’s time to replace you with somebody else who’s been to that rodeo before and then that company got destroyed or that the value proposition got decimated and then you were asked to pick it up and go forward. Is that accurate? I give you a little overview of that.

Ken: Absolutely. Yeah exactly what happened is is that you know what. After my third round of investment and we had Sequoia Capital the best you know in the best of Silicon Valley come in as our lead investor in the first round and we rode through two additional rounds with them we had one bad quarter and I remember sitting in that boardroom and they’re like You know what. We want somebody that’s seen the movie before. So if anybody ever tells you you know we’re going to bring somebody in that’s seen the movie. I don’t know that I would believe it because who they brought in hadn’t seen the movie it was a corporate executive. I was told we were going to get the best of the best and I’m like OK. They said hey you haven’t done their national yet you haven’t built channels yet but you’ve built a really nice company right. And we want you to stay. We want to be part of the company want you to be the chairman and the leader the thought leader of the company which I had established a company as there was a little hard to pull me out without kind of breaking some things right. So they brought the guy in and in 18 months literally destroyed the company we were worth almost nothing.

Jim: So we’ll talk about that but I want to ask you a relatively sensitive question that is how did your ego how did you handle that ego side of having been the founder CEO led the company. Now you have to step over to this other position which is in some way a step-down and start to say the least and support the new CEO. It’s very difficult to do that. How was that mentally for you philosophically.

The Emotional Toll when a Founder/CEO is Replaced

Ken: Well, first of all, I’ll say a lot of CEOs or a lot of founders actually can’t make that transition and you opt-out because you just can’t you can’t control things. It took a lot of a lot of energy I always to say I’m still in therapy over it because it was a very traumatic event and it was traumatic for all my employees and all my customers because I was very intimate with all the customers I had sold them I was also kind of the face of the company from a sales perspective. So we were all one big happy family and when that new CEO came in he was in the exact opposite. Remember the first day that we actually did the meeting he said you know we had probably 200 employees at the time and he said Hey anybody wants to leave you can leave now you know I’m the new guy in charge and that’s it. You’re going to play by my rules and that’s it. So it was really quite traumatic. I remember that first meeting very well but my ego you know what I learned the best less I would say that it was the best thing that ever happened to me. And the worst thing that ever happened to me all in one as an entrepreneur you’re very attached to the company you’re very passionate. Everything that happens good or bad. You weave emotionally in the company and that’s a very typical entrepreneurial thing. Well, I was I was addicted at a pretty high level. Right. And I was working 100 120 hours a week. I miss the crazy Silicon Valley entrepreneur. And it made me detach emotionally from the company and it took me years to do that. But I was able to detach. Right. And I just sat on the sideline. The thing is unlike maybe even a lot of entrepreneurs at the time I owned a lot of that company. So just leaving it and leaving what I had built over 13 years 14 years as I didn’t seem to be a good move for me. So I hung out I stayed I contributed I was still the leader of of of that thought leadership and the champion of the company and I was able to kind of persevere through it.

Jim: Yeah I mean you had such a large chunk of equity of the company that you had to stay and protect that.

Ken: That’s exactly. That was my main motivation. And I didn’t want to let down my customers and my employees because they they were part of me. And so and it was also my identity as well. That gets back to the ego question. So but it was again it was the best lesson because I learned the lesson of detaching emotionally from what was going on and just kind of watching as an observer. And that’s when you start to get your ego in check. I was still furious all the time and I will tell you it took us 18 I knew as a wrong guy like three months into it probably a month into it. It took 18 months to the day to get rid of him. Six months. The seas are in love with the guy right. They let him do anything he wants. Right. And he did. And then six months people start to wake up and then the last six months is the time that they flip on him and it takes about six months was 18 months of the day to get rid of him. So I called my 18-month rule. All right very good.

Jim: I want to come back to the story of when you took over then. But Mark I want to come back to you and let you just comment about you work with a number of companies here in the valley the marketing positioning marketing plans based on some earlier conversations. It’s pretty common. What Ken’s describing about CEOs being replaced.

Mark: Yeah it is. As an adviser to companies. We’ve we’ve seen the movie a bunch of times and typically there are multiple stages and you get a founding CEO who’s usually very engineering-driven and close to the product and then at some point the voices suggest maybe a second growth CEO and they scale the company and then the third stage. Oftentimes it’s sort of like an exit CEO who has a network to find out the probable buyers. And that happens actually more often than you would think. And you’re the founding CEO if they’re smart they’ve sublet me at their ego. But in a few rare instances and Ken is one of those rare instances they’re just bright enough and genius enough to to be able to be the successful CEO at all three of those statements and takes a lot of growth.

Jim. And when you see this as your replacement event take place. Did the companies make it through or do they stumble and fall apart or what what happens in your perspective.

Mark Well a lot of cases they make it through it’s the right thing. I mean the V.C. is have seen the movie before too. So there are a lot of them. They did this for all the right intentions but either it’s a cultural misfit or they’re completely lacking the vision which I think in the case of what Ken described is what happened. You know you plug somebody in who does it just doesn’t have the same passion the same vision and they just can’t lead the company. And it’s one thing that to sort of operate the company on the books. The other thing the lead all of the employees in the company and lead him in the right direction of you know often there in the heavens.

Jim Ken now, that day comes, it’s going to happen you know and everybody knows it personally. What happened the company’s been decimated in terms of the value proposition.

Ken Our customers were leaving they were very upset. You know I mean it was we were in the e-commerce business doing about two billion dollars of e-commerce of commerce. So we had a lot of money floating through our system at the time. So we were responsible for a lot of stuff and customers were just there livid right.

Jim OK, So you come in.

Ken I actually didn’t come back in that we brought actually the CFO of the company in for a couple of years. And that was also a stupid move in my opinion. I didn’t know what the company was really financially decimated as well and so the visas were trying to decide to put more money into it. And they did ultimately as well but that was all. I don’t very much believe that a CFO necessarily should be a CEO of a company and a founder. No vision. Everything was financially motivated. Really good for the first year really bad for anything. Dealt with growth because a CFO mentality is to look at everything kind of in a pessimistic way and risk-averse wait which is not what an entrepreneur’s talent is. So as soon as we got. Rid of him then I came back in and it was time for the turnaround.

Jim All right now. So the CFO steps in, kind of runs in a mediocre way where nothing gets improved. Maybe the finance was get tightened up a little bit then he by choice leaves or she by choice leaves or the board regroup. Really. So.

Ken: Well you can say by choice because on the day that he was going to get fired he quit surprisingly which by the way happens almost all the time because they’re smart enough to know hey this isn’t working and we were looking at a potential transaction. The transaction was valued at thirty million dollars. He really wanted it to happen because it was going to benefit him personally and benefit his career. And we were all looking at it going. Yeah, word. This is not really good, in fact, he way undersold the company so the transaction could actually occur once we kind of realize this and I knew it was going on the whole time. I obviously convinced just one or two of the visas that we’re in because we were you know we were fairly well bonded we actually had a really good relationship which is also a bit unusual as well. You go through your ups and downs you go through your jobs and everything. I will say at the end when the transaction occurred I still today have a great relationship with all my visas and even if we had little challenges here and there I got lucky because I really did get a good group of VC’s even if they did replace me. I still got it I got a good group of VC’s.

Jim: You are so kind. Let me ask you just to kind of get the baseline here so 30 million offer what is a return to the investor base of capital whether it would be a 2x 3x.

Ken: On the 30 million. It would have probably been a one X.

Jim: A one X.

Ken: It would not have been a good return and it would have been a good return for me even though I had still held a good percentage of the company and that’s something we just want to talk about it. Well before we leave is how does an entrepreneur hold on to this company because most entrepreneurs if they actually have a successful exit, exit with less than 5 percent ownership in their company which when I heard that stat it was just like you got to be kidding me. That wasn’t my case. Thank goodness. And I had to fight for every dime of it.

The 5 Key Initiatives to Revitalize the Company

Jim: So on the topic we have to do that and we’re gonna include it in this one so we’ll make a little allocation time. Touch it because it’s a great topic. So. Okay. Tell me about the day you come back and the CFO is resigned and you’re left with the company has totally been decimated customers fleeing all the metrics are in the wrong direction.

Ken: Yeah I mean you know the bottom line is I said it I basically created what I call key initiatives I created five key initiatives and I ran the company on key issues of first and first kind of month when I came. Back and really reassess. I never left the company but when I came back I interviewed every employee I talked to every customer personally when I came back and everybody was fairly excited to have the passion of the entrepreneur back in. So there was an initial euphoria that kind of was associated with the company that helped a lot. I put in five key initiatives and I said I’m going to manager my executives. I actually had a pretty good too really good executive team. I didn’t need to make a lot of changes and I had already been working with them as well. So when I came back in I said hey I’m going to run I’m going to manage to the executives too I’m going to only manage these five key initiatives. That was the key to getting the valuation that I actually got at the exit. And I actually told the board and all the investors if you asked me about anything else other than what’s on this sheet of paper after we agree to it. The five key initiatives which is getting gross margins up increasing efficiency getting growth back into the company and a couple other things and improving overall morale. I remember was one if you asked me about anything else. I’m not talking about it and every board meeting was anchored on those five key initiatives. Outside of a financial update and every company meeting which I had every month was anchored which is a little bit more frequent than most people do. But I had every month was anchored on those five key initiatives. That’s all I focused on. And that’s actually what got us from a really really bad 30 million dollar valuation we sold for over a hundred million dollars. Two years later what was the transition time from the day you took over to the day you could see a light at the end of the super easy two years period a year or two years to the day. Exactly. And by the way, it takes two years to recover a company and we had to really restructure we were about 50 percent gross margin by the gross margin for those that are listening out there. Very important profitability important, to gross margin in the software business really important growth really important right. So we were at 50 percent gross margin which is basically a service margin kind of company or I mean a good service company and we were a product company. So we had really crappy gross margins. I was able to get him to six while our team I shouldn’t say meet our team was able to get him to 65 percent or a little higher than 65 percent by the time we sold we were profitable at the time we sold as well. And we had growth. So all three of those things actually came together as well but it did take two years by the way.

Jim: Mark, when did you get involved with the company market. At what point soon after Ken took over?

How do you Prepare a Company to be Bought?

Mark: So our business is helping companies optimize for that exit and optimize their valuation. And what we’ve done is we’ve sat down with a bunch of M&A executives and we’ve mapped the valuation levers we call it that best optimize for best predict to a higher valuation and then we sit down with companies and we start working on those on those drivers and we really focus on those so that the ultimate valuation of the company is higher. I should point out we’re not everyday brokers and so we come in before the emanate companies the M&A brokers are out there the day they get involved they’re out shopping the company on the street and what happens is a lot of times the valuations don’t come in what the entrepreneurs and what the investors expect and a lot of times those value being acquired is a negotiated number to your point companies are bought. They’re not sold. So a buyer finds a company that they like and then they negotiate a price. And if they really want it that price goes up and up and up and there are some drivers that we can talk about in this podcast that will increase that will optimize and increase that valuation and attract that strategic buyer who really really wants you. And that’s what we do we help the companies optimize for that ultimate exit.

Jim: I’m looking at your write up here about Xrocket and about Market Live. And one of the things that I noticed right off the bat is is that somewhere the decision was made not to go after the high end and not to go up the low end but to own or dominate the mid-market. Was that an easy decision and analytical. Did it come about? I mean that’s a pretty big decision so we’re going to not we’re gonna ignore these other two segments the high and the low. We’re going to dominate because it’s available for some reason or no one’s dominating so far 100 that decision come about.

Ken: Well, I think it was it’s actually at the core of market live going back years as well. However, continue to get more and more focused on the mid-market. We call it mid and upper mid-market. That was our sweet spot but it also is driven actually by our technology as well. We weren’t really right for the small end of the market and we weren’t really right for the large Oracle type. You know we call A.G. or Oracle commerce now is when it’s called today. That was at the high end the market so we actually fit right in. Our company was geared because we did have a little bit of a service arm of our company so we were really intimate with our customers. We were also thought leaders. So that was something that I based the company on from the early days. So the people that were attracted to us were these mid-market and upper mid-market companies that didn’t fully understand e-commerce or didn’t understand how to optimize it so our story resonated really well. And we were very very feature-rich but feature-rich for that market.

Discussion about how to Create Thought Leadership

Jim: Mark, I am going to ask you a question about Ken. He’s a thought leader, I mean he’s a completely compelling guy an engaging guy. How do you how do you get somebody how do you counsel a CEO or a founding member to be a thought leader?

Ken: Well, being a thought leader is pretty important because that is one of the big valuation drivers you want to be. You want the strategic buyer to find your company a lot of times they find you or they choose your company amongst others because there is an outspoken CEO who defines the category. And Ken is one of those categories. How do you do it. You do need a naturally talented CEO for sure. And then you have to find a platform right. You have to build a platform and that could be contributed articles that could be a blog that could be rich content that could be speaking. If they’re particularly engaging on stage but you need to find those platforms to allow that CEO to become that thought leader for that sector because that is part of the strategic valuation of the company becomes the CEO’s role in that sector.

Jim: I am fascinated by this because I see a lot of CEOs that want to become a thought leader believe maybe they can learn to be a thought leader. But having a have Not a clue about how to go about being a thought leader. So any other insights that either one of you can offer about what’s it take to be a thought leader. You mentioned platform you mentioned natural talent but I gotta believe a person could learn that or is it not learnable.

Mark: It helps to have some data and in the case of market live one of the most successful tactics that we did was there was we did publish an index report every quarter and it was a measure of market live customers and their e-commerce metrics. You know average order volume things like that but then we compared it against the Com Score numbers for the market at large and what we did was and we indexed it and we called it the market live customer index or the e-commerce index and we publish it reliably every quarter. And that became a market bellwether for the mid-market segment of the customer. And that became sort of institutionalized and that became the number that you know equity analysts anticipated journalists would anticipate that report coming out. Ken would talk to that report and illustrate why people would see directionally the change in the market. It really we institutionalize that number that was a huge huge data play that he could then speak to.

Some of the Key Initiatives

Jim Ken, we’ll go back to you. So you come in, what were some of the things you had to do or you felt you had to do. Were there any mistakes you made in that ramp up after the first three months right.

Ken Yeah. Well, I’m sure I made a lot of mistakes. However I think the thing that I that that was really important to me was to engage the team we had all the talent we had a couple hundred employees we had great executive team and we had very supportive investors because at the time the investors were basically said hey you know just go fix us and come back to us when you need help or whatever you need. So the first thing I did is I actually raised a couple of million dollars because I was left with nothing. I was left with almost nothing in the bank. So the investors were great. I went to each one I did my Sand Hill Road pitch to the person like when I went into Sequoia, they were like not even a question. It wasn’t like they had the money. I mean we were an old fund for Sequoia. We had been invested in two thousand three and Noack and they wrote us off in 2008 like they did every other company in their portfolio practically. So when I went back and asked them for literally a million dollars and they said they were like no problem they wrote the check-in a second. So I have to give credit to the CEOs who gave me the working capital. I didn’t want too much money. I could have gotten four million. I only actually asked for two million because I had done the math. And did that. I got the financials in order so I actually knew what I was driving towards right. And the next thing I get is I was very obsessed with gross margins and customers. Those are the two things. So I got really engaged with customers at a very intimate level again and really re-engage the customers come back to kind of art be our champions because we had a huge problem which Mark helped a lot with which was our reputation. Our reputation had been decimated really. So I had two years to kind of recover reputation and that reputation doesn’t come in overnight. You really have to work hard for it. So by reengaging the customers back into the process that was very important. The key thing that I actually did was we actually did, as we went over to AWS. So one of the big margin, I had to improve the gross margins. So I got all of that customer service kind of issues squared away because that was dragging down our gross margins and we switch over AWS. It might not seem like a big deal but we were doing two billion dollars of commerce. We had thousands of servers literally in our own hosting facility that we owned and we needed to transition everything over because that was really done with buying servers. And the main reason is remember where e-commerce so we had to buy servers for literally four days out of the year right. The Cyber Week and Thanksgiving and a little bit into Christmas and then a little bit after Christmas. So the whole idea is that as that we have to stabilize that business that was a huge move that we made and then bringing the morale and passion back to the company I knew we needed to do that. So I needed the energy of everybody that was associated. So I required that as being something. Also if I can say our prior CEO created this thing and not another one to be negative about him or what he did but he created this kind of blame culture and I needed to get that out. So everybody was accusing everybody of everything else it was everybody else’s fault for the challenges that we had. So I demanded that we stop that immediately I enacted a basically a program and put a senior leadership team in place which we didn’t have. So we had an executive leadership team I put a senior leadership team in place and asked them to work on those types of problems. And nobody answered emails which drove me crazy. And I always I’m a big believer in answering emails when they come in because that’s how I was trained. And so that had to be stopped and I asked all the employees to call if they weren’t getting answers response talk to your fellow employees and reinforce that at that level. And I empowered everybody to do that. That was another thing that was really important.

Jim: Boy, that’s a lot of stuff. I like the unpact that. But did you come up with this yourself or did you have a team or did you resonate with Mark about it or.

Ken: I think all of the above right. I don’t want to take credit for it. Mark was really on the reputation rebuilding activities and everything out external to the company so he brought his team in. We got a lot of press. He pumped the company back up from an external perspective which is exactly what I wanted him to do. And then the executive team really focused in on the internals along with myself. And you know you do it right. You talk to people you communicate. That’s how I figured out where things were wrong. Now again keep in mind I’ve always been with the company so it wasn’t like I left and came back. I was always there so I kind of knew what was wrong as well. So I had a head start in my particular case but my advice to the entrepreneur is if they ever find themselves either in this situation or they are actually are running the company and are kind of getting a little disconnected from it talk to people. Talk to your customers. Talk to your employees and don’t be afraid to get a lot of feedback. I literally sat down with every employee during that period of time the first couple of months as I came back it was a lot of work but it is really important to the process.

Jim We’re going to come back. This is gonna be the teaser at the end of the show.

How to Rebuild a Damaged Reputation

Jim So, Mark, what do you do to revive a broken or lost reputation?

Mark Again it comes back to those valuation drivers. You need to focus on the core. And I want to come back to a little bit to positioning the company for the mid-market. So to some extent, as Ken pointed out to some extent the product and the engineering dictated that and to some extent the customers dictated that. But it’s not always a foregone conclusion right. I mean sales is thinking oh yeah we could go move up the value chain a little bit and we can sell into the big enterprises and they get smacked back down by demand where one of those huge companies and then they’ll sales also thinks oh well we’ve got a great technology we can go downscale and pick up those things and then they get smacked down because there’s a product like Magento that’s open-source and essentially free. And it’s hard to. So one of the big eye openers was deciding to really embrace and own that mid-market and and and communicate everything about the company that we were going to be the leader or we are the de facto leaders in that mid-market spectrum and doing that’s how it is one of the ways that you become a sector leader is you decide what sector you’re really going to own. And you ignore the distractions and you just go for that, go for that brass ring.

Jim And when you say own it you mean the thought leadership the general product leadership you’re gonna do everything that market needs that makes you the best value proposition for that market is that accurate?

Mark And the perception in the market place that you are the de facto leader in that segment. And that also goes back to the title of this podcast. That’s how you get bought not how you get sold.

Contact Info

Mark Addison : m.addison@xrocket.io

Jim Connor : Jconnor@gamechangers.tv

Website Link - : www.EntrepreneurNow.com

Ken Burke can be contacted on LInkedin, or at www.EntrepreneurNow.com

Mark Addison can be contacted at m.addison@Xrocket.io

Jim Connor can be contacted at jconnor@gamechangers.tv

or the website https://gamechangers.tv

Leave a Reply

You must be logged in to post a comment.