Overview

What are your options if you have a viable business, capital is necessary to develop and grow, but there is a lack of engagement from venture capital?

In 2015, Congress implemented Title IV of the Jobs Act, which was intended to provide a process for startup companies to all investors by selling stock to the general public and investors while remaining a private company.

Why haven’t you hear about this process, knows as a Reg A+? The provisions of Reg A+ allow a company to raise up to 50 million, but there are compliance regulations, audits, and SEC-mandated disclosures. But the opportunity to sell stock to the public and create an investor base for funding future growth expands the opportunities for the startup community to develop new sources for funding.

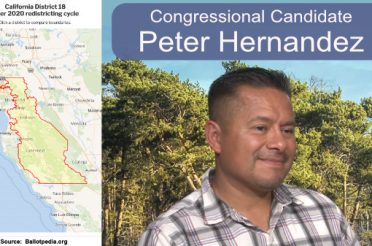

My guest on this topic is William Santana Li, the Founder, and CEO of Knightscope, a company that provides autonomous robots for security services. When Bill was not able to secure venture capital funding, he decided to use the Reg A+ process for a mini-IPO. Bill will lay out the process, the motivations, the obstacles, and the unexpected upside rewards he experienced.

Transcription

[Jim Introduction]

We all like the contrarian story about the person who, takes the path less traveled, engages with known obstacles, encounters with previously unknown challenges and inaccurate information, and yet somehow manages to succeed.

In 2015 Title 4 of the Jobs Act went into effect allowing companies to raise money by offering shares to the general public. Prior to that time, a start-up company could find investor capital only from accredited investors, represented by private venture capital, angel investors, and in some cases corporate venture capital.

[Quoted Statement from Bill]

So I’ll tell you a funny story. So one of the VCs that I’ve known for a long time. She’s like, Okay. We had done the largest mini IPO history that I know of, I think we were trying to raise 20 million bucks and we ended up way oversubscribed 26 million dollars.

And she sat me down, she’s like, Okay, can you take half an hour, just explain to me what the heck did you guys do from a financial, legal standpoint. How does it all work?

It was by the 29th minute she turned pale. It’s like if every founder knew what you knew by definition, we’re not required.

[Jim]

My name is Jim Connor welcome to Game Changers Silicon Valley. tonight’s show is about the experience and lessons learned by a company founder, and CEO in conducting a mini IPO for his start-up company.

My guest is William Santana Li, Founder and CEO of Knightscope, a company that provides a line of advanced robotics that incorporate autonomous driving and artificial intelligence.

Bill, welcome to the show, you have a great story about perseverance in the fundraising effort. Can you give us an overview of the initial process you went through to fund your company’s operations?

[Bill]

Sure, thanks for having us, first of all. When we first started, it was very difficult to get the traditional investors to participate, we’re based here in Silicon Valley, but most of the capital, the 80 to 100 billion dollars that goes into start-ups every year is primarily focused in biotech enterprise software, maybe mobile apps and a little bit of clean tech and that sort of stuff, but it’s highly concentrated in particular areas and in some cases it’s very valuable for a founder to get that kind of capital into their capitalization, or cap table.

In a lot of cases, there is not a good fit. In our case, we built fully autonomous security robots back in 2013 out of the 800 VCs. Would you like to name me the expert with the track record in law enforcement, physical security, robotics, and hardware?

And that me, as an officer of the company, should pay a premium for that kind of capital. And for… It just wasn’t a fit, a lot of the investors didn’t understand what we were trying to do.

It’s too complicated, they didn’t have the sector expertise, etcetera. So we ended up raising a good amount of capital from angel investors to get going and then we added… I think by that time corporate venture capital about 20 to 25% of the money was actually off of a balance sheet, so we ended up bringing four major corporations as backers.

But then as you mentioned in the intro, the federal government changed the rules to effectively allow a private company to do a public offering and then remain private. I’ll say that one more time. A private company can do a public offering and remain private. And as an officer of the company, I take that rather seriously. We need to find the lowest cost of capital, and the right fit to benefit the shareholders. And what I find really funny and probably may end up offending some of the audience…

So in the public markets, if someone buys 5% of your shares, what happens?

Oh ! Activist shareholder, emergency board meeting, the bankers are all looking at the media analyst, it’s haywire, everything goes crazy because you don’t know what’s gonna happen.

I find it rather humorous in the private markets, some investor around here buys 20% of your company, steals two board seats, and the CEO sends out a celebratory press release, the next day and I’m like, “I don’t know.”

Unfortunately, a lot of the founders, it’s beaten into them, here in the valley. That you need product-market fit, you need product-market fit, you need product-market fit, and they don’t wanna really talk about capital to company fit. What is the right kind of capital that should be put into your company for what you’re trying to accomplish? It’s not to say that the VCs are bad, but they’re not supposed to be in every sector, so it’s important for a founder to really look at all the opportunities around them to raise that capital.

[Jim]

Let me go back to the point you mentioned though, and this is for those who experience it, it’s a big disappointment, and I don’t think it’s talked about enough. And that is, as you said, somebody put some money into your company, maybe a raise is done, and there’s a lead investor, a venture capital lead investor and a couple of other syndicated partners. They come in and take two board seats, and suddenly they’re your new boss, they’re starting to control the company, they’re starting to hold you accountable for what they believe is the right direction, without necessarily having the proper experience and background.

[Bill]

And in a lot of cases, those board members need to recuse themselves for a lot of the meetings. A lot of the funds are six, seven years old. So if you’re on your sixth year of your fund and your company is making some progress and you get an offer to buy the company and the single shareholder, outside of all the other shareholder says: “No I’m gonna vote my shares to sell the company.” Well, why is that? Well, I gotta return money back to the LPs. ’cause it’s a seven-year fund. You’re actually conflicted. Like founders shouldn’t be selling board seats to the highest bidder. It’s just highly inappropriate, in my eyes. And I think if a founder has the right to set the strategic direction of the company, the technology recruit all the team members, go after whatever customers they wanna go set the culture, set everything but they don’t have the right to find the right board members at the right time with the right skill mix with the right demeanor, you probably need to rethink a little bit of the things.

And what I also find fascinating is you’ve got all these VCs dumping like I said, 80 billion dollars a year into disrupting everything, education, financial services, government, biotech, disrupt everything.

So you wanna change the fundraising process?

Now, hold on here, I don’t know about this. We should take another look, or we’re gonna pass.

[Jim]

It is interesting that entrepreneurs can break rules, can do all types of things that destruct the industry, but you cannot break the rules of the fundraising process.

[Bill]

So I’ll tell you a funny story.

I ended up, so one of the VCs that I’ve known for a long time. She’s like, Okay. We had done the largest mini IPO history that I know of, I think we were trying to raise 20 million bucks and we ended up way oversubscribed 26 million dollars.

And she sat me down, she’s like, Okay, can you take half an hour, just explain to me what the heck did you guys do from a financial, legal standpoint. How does it all work?

It was by the 29th minute she turned pale. It’s like if every founder knew what you knew by definition, we’re not required. I’m like, “I didn’t say that you said that.”

But there are other ways to raise capital and it doesn’t always have to be. And again, it’s not that all the VCs are bad, there’s some awesome, awesome talent up on Sand Hill Road and elsewhere that do really care about founders, do really have sector expertise, but that is a small, small minority.

[Jim]

So, for the benefit of myself and our audience, let’s go through how you did this.

You had some money, you had the core investor group, you say “I think I wanna take a chance on this “mini IPO”, this Title Four Reg A.

Did you call somebody up? And they said, “We don’t know what you’re talking about”. What happened here?

[Bill]

So it was a dream of mine back in, before 2012. You could actually stand up and say, “Yeah we’re raising money.” It’s actually illegal to do that. Unless you had a pre-existing relationship with someone, you actually couldn’t solicit them for an investor so if you had no network and you didn’t know anybody, you’re raising zero.

So, I was reading through the rules and it’s like, Okay, there’s an opportunity here to tell your story, see if there’s interest. And then you’ve got 12 months to solicit up to 50 million. We did in a Reg A plus Tier Two. But you have to conduct yourself in a more grown-up way.

So most private companies by the time they get to filing an S1 and do an IPO everyone’s scrambling, right? Or their first audit, they finally brought in a CFO. You need to get your house in order, you have no controls in place, you’ve got no disclosures, you’ve been just basically raising money behind closed doors. Board Minutes yeah, I… Yeah, board at all that good stuff.

Now, you’ve gotta be kind of semi-public. If something material happens during this interview right now, I gotta go call a counsel and go file a form on you, but you’ve gotta start. It’s a great baby step to being a public company.

Now, you’ve got to put some controls in place, you might have to hire some staff much earlier than you’d expect to, but it’s all good hygiene for you to be able to do that, so you need to… In a lot of cases, you should probably have a registered broker-dealer involved to actually facilitate the transaction.

[Jim]

That’s to transfer the stock for cash.

[Bill]

Yeah, and then you wanna make sure that you’re first filing with the SEC, and I probably over-did this, and I’d probably do it the same way again. We had two separate legal councils, we had our normal corporate counsel, and then we had a SEC… kind of focused counsel.

And usually, the client is the one that goes overboard on wanting to be a little bit loose.

And in this case, I went the complete opposite, and then you file the paperwork after you got your audit and everything done with the SEC, and then you got a wait for comments. The SEC might come back and say, “Hey you didn’t explain this correctly, this is not right. You need to address these 17 issues” and that sort of stuff.

[Jim]

Had you maintained audits throughout the prior year? So you have only done reviews or a…

[Jim]

That first that must’ve been expensive.

[Bill]

Yeah, you’ve gotta set aside enough money to do it, you gotta set enough time. That’s one of the things that people don’t realize is, to do that kind of offering besides getting everything and ready. You’ve got third parties now involved. So it takes a good amount of time.

And then it was interesting for us we did a really bang-up job on the offering document, we literally got one comment back from the FCC. A single comment and we had intentionally at that time, not put the price of the shares, and that was the only comment, so we filed, offering went live. And then, most entrepreneurs think like, “Hey let’s just put this up. And it’s like an ATM machine, the money will just start flowing in.” It doesn’t work that way. Now that you are thinking of selling your technology now you’re selling a security you’ve gotta go sell it. So what would be a two-week IPO roadshow is not concentrated in two weeks, you’ve got 12 months to go and when you start, it’s gonna be hard.

The other thing that a lot of more sophisticated investors don’t appreciate is the valuation that you set. You have to be, one suggestion would be… you’re kind of a little over-priced in the beginning and… because you do rolling closes, it’s not one big escrow that gets released by the mid-point of the offering, you may be priced to the where you should be, and then by the end, you’re really upset ’cause you’re really under-priced because you were able to take the capital and use it as it’s coming in. And a lot of large institutional investors don’t like to see that, they wanna squeeze you to the end and make sure that everyone wires all their money on the same day, like when you buy a house and then you can use the capital.

[Jim]

So let me just confirm a couple of things here, ’cause you actually touched on a couple of things I wasn’t aware of. You do have this one year period which is kind of a testing period for you, this side or…

[Bill]

No, no, you’re live.

[Jim]

You’re live. Okay, you have the one-year period where you’re alive, you can take capital and have a rolling close, did you do it quarterly, monthly, or whenever you get money?

[Bill]

I think we probably did two dozen closings.

[Jim]

Okay, so was there a minimum you raised before you would do a close?

[Bill]

I think maybe we’re close to a million boxes, or something like that. Or timing or we needed the capital for something, and sitting in escrow just closed, or what have you.

[Jim]

And then you issue the stock to those new parties, it was preferred stock, I believe, correct? And then you continue to grow the company.

How did you arrange your investor meetings? Did you go to an industry that you thought was appropriate or…

[Bill]

Like you said in your intro, we’re in uncharted territory. We try everything, right? You do at the time, amend what I’m about to say. You do online advertising, offline advertising, you go take one-on-one meetings, you get people to come to the office, you go to events, you basically, you’re on a 12-month road show.

[Jim]

Are you going to professional investor events, people who actually invest in public trading securities?

[Bill]

Yes, yes, yes, yes, and yes. Any audience you can get, you go try it and depends on your company. For us, it was a little odd. We’re technically a business to business and business to government company, and a lot of the broker-dealers would tell you, unless you have a business-to-consumer type of play, you really shouldn’t be doing this because the business-to-consumer, you have a bunch of “fans” that could potentially, you can monetize that and you have an audience to go reach out to.

We didn’t have that, we didn’t have a million Instagram followers that we’re gonna go.

“Hey” at the time, we’re selling at three bucks a share.

Hey, you know, would you like to invest in the company?

But I think we’ve kinda proven that the other way. I think what’s really odd and that the government is starting to realize is: you could go to Las Vegas, we can go all right now the entire TV studio… Let’s go get on a plane, go to Vegas, put everything on red. And it would be legal to do that. Like your house savings, like your car, everything you can go, but you’re not allowed to buy stock in the start-up down the street.

[Jim]

Horse racing too, same with horse racing.

[Bill]

Yeah it’s a little convoluted but for the entrepreneur, if you’ve got a chance to set the price, set the terms, set the timing and not sell a board seat, I would argue that you at least have the fiduciary responsibility to vet the opportunity and see if perhaps it might be a fit for you.

I’m not saying that this is a good thing for a lot of start-ups, a lot of start-ups wouldn’t survive the process, especially if it’s a… Maybe first-time founder, or first-time founder without a really sophisticated CFO or someone that’s been around the block. It can be a bit taxing, especially if you haven’t been through the financing.

[Jim]

Did you do the presentations with your CFO?

[Bill]

At the time I was the CFO and the CEO.

[Jim]

And you went and gave a pitch to wherever you could do the pitch. Did you go to private offices such as family offices or what?

[Bill]

Yes, one of the interesting things, the family offices, we’ve resonated very well with is that for those founders that don’t understand how the process work, the family offices, and the endowments and the pension funds and insurance companies are the limited partners that put money into the venture capital firms, and then the VCs put the money in And they end up paying 2 and 20 and some of the family offices, start getting really kind of tired…

[Jim]

In other words, two percent per year…

[Bill]

And 20 percent of the profits. And so they’re getting tired of getting locked up for 5, 10, 12 years, and having VCs dump money into opaque startups that don’t really report out what’s actually happening. The VC business model is to be wrong nine times out of ten, just to be abundantly clear. And some of the family offices are like… Oh, this is interesting. You actually report to the FCC every six months as if you were publicly traded stock. The shares are not in an exchange yet you actually have to disclose everything. I don’t wanna pay the VC, 2 and 20. I’d rather do a direct investment

[Jim]

So you did a number of closes during that first year for that first raise. And did any of the investors want board seats or did they want regular, well you disclose everything to the FCC so information rights is not an issue, is that correct?

[Bill]

It’s basically “take it or leave it”. Good or bad for the last five-plus years for Knightscope, we don’t actually accept term sheets, the with the concept of a lead investor and that sort of stuff… We set the terms, and it’s take it or leave it. It’s rolling clothes. If you don’t wanna participate, we’ll find the next person until the entire round’s completed. So now we’re, in total raised over 40 million dollars, we’re backed by 6000 family offices, private investors accelerators and corporations and nobody sees on the cap table.

[Jim]

So now, as I understand it, I hope you verify this, that stock is tradable, correct?

[Bill]

It is not on an exchange. We don’t necessarily spend too much time worrying about secondaries and that sort of stuff. So we’re kind of a semi-public company, as I mentioned, every six months, we have to report to the SEC, we’re raising 50 million dollars now, to get the company to close the profitability and… Then probably put it on an exchange at that time.

[Jim]

Okay, I miss next raise. Okay fine, then people can trade on the exchange, correct?

[Bill]

Yeah, then we got brave enough or bold enough to, we reserved our ticker symbol and NASDAQ, it’s gonna be KSCP. So that’s what we’re shooting for. Obviously, as an officer of the company, I can’t promise an IPO, but that’s something that we’re looking at.

[Jim]

And the last comment, once you’re an exchange and anybody can buy the stock, you don’t have to be an accredited investor, is that correct?

[Bill]

For a Reg A-plus offering pretty much any accredited or unaccredited investor can participate.

[Jim]

Any member of the public and that’s gotta be a big draw at some point too, I imagine.

Last question, if you had this to do over again, what would you do differently or would you do it exactly the same?

[Bill]

Process-wise, I would do the same thing all over again. Who’s in the 6000 investors, a lot of more sophisticated or institutional investors like you, they must drive you crazy.

You know, 6000 people calling you every day.

And it’s not that case. I get maybe one, two, three, four emails a month and it’s usually how can I write another check?

Can I introduce you to this potential client or here’s a potential recruit or what can I do to be helpful? And we’ve got Chief Security Officers of major cooperations as investors, we’ve got vice presidents, a leasing agent of major malls, we’ve got NYPD… Detectives CIA, FBI DHS. I would never dare trade out our 6000 awesome investors for two or three investors that perhaps don’t have the sector expertise of what we’re trying to do and are not guided by our long-term mission of what we’re trying to accomplish.

[Jim]

That’s great. Bill, this has been remarkable, the story is remarkable. You’re remarkable on how you did it. So, I wanna thank you for joining us and I am sure that there are many people, I personal friends who will thank you, I’m sure, for this information, so thanks so much, your company is Knightscope.com.

You’re in Mountain View if somebody wants to follow up or has an interest in… Learning more about the investment opportunity, they can go to the website and learn…

[Bill]

Yep just go to www.knightscope.com… Join us and be a force for good.

[Jim]

Great, thanks so much again, Bill, I wish you every success going forward.

[Bill]

Absolutely, thank you so much.

[Jim]

This is Jim Connor, thank you for joining us for this week’s episode of Game Changers Silicon Valley. Each week we’ll address an area of innovation that may emerge as a game changer of tomorrow. You can follow us and subscribe to the shows at game changers dot TV. We look forward to your continued interest and participation in upcoming shows.

Podcast

For more information on the company, its products or investor information, please go to www.knightscope.com

for the podcast, please click on the link below:

Leave a Reply

You must be logged in to post a comment.